How To Write a Cheque: Details

Cheques are financial instruments that enable users to perform secure transactions. When these checks are improperly written, the bank may reject or invalidate them. Any type of insufficient funds or overwriting error on the check can make it difficult to process.

In order to correctly manage a cheque, you must be knowledgeable with all of its components, the parties involved, and how to write it.

To write a cheque, you first need to gather all of your information:

The payee’s bank name and account number The payer’s bank name and account number The date on which you want your check to clear (this can usually be tomorrow or next week) Your memo line (optional) Instructions

What is a Cheque?

A check is a bank deposit slip that the bank approves and sends to the payee. The payee deposit this slip of paper into their account at the bank, which is how money gets transferred from one person’s account to another.

Before writing the Check you need to have the following information :

- Your Bank account number :

- The full name of the person or company :

- The amount of the check (in dollars) :

- Date of check: Present in the right corner of the cheque.

Before you write a check, ensure you have the funds to cover the purchase and consider alternative payment methods such as electronic transfers or debit card payments.

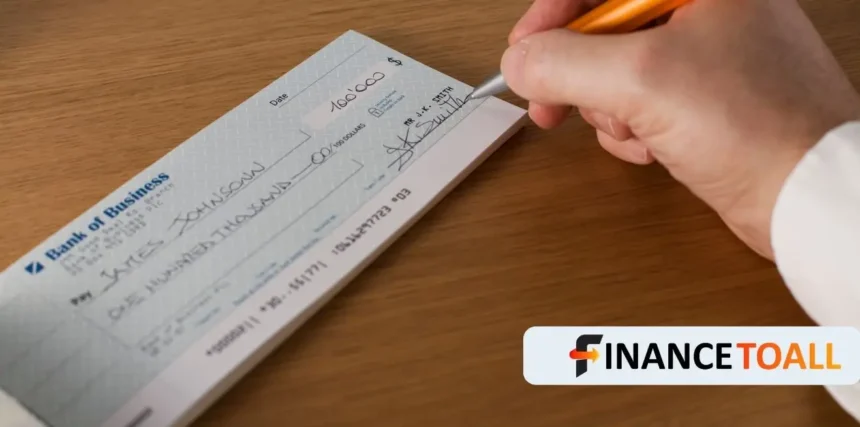

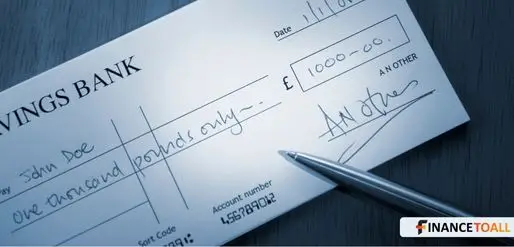

You should write the payment amount in both words and numbers, and you should carefully fill out other fields such as the data line, signature, and memo line.

Recording details in a check register can record more information than your bank statement will show, such as who you paid and why.

Here’s a step-by-step guide to help you fill out a personal check

Writing a check can be a daunting task, but with the right tools and guidance, it becomes much easier. Here’s a step-by-step guide on how to write a check:

How to write a Cheque – Basic steps

Cheques are a formal way of paying for goods or services. Writing them correctly is essential for a smooth payment process. Here are the basic steps you need to know:

1. Write the date on the cheque in the lower left-hand corner.

2. Check the amount of the cheque and the payee’s account number.

3. Write the payee’s name (or title) on the line below the amount of the cheque.

4. Sign your name below the payee’s name (or title). That’s it! Now you’re ready to pay!

1. Fill in the date

It is always important to write the date on the cheque, so you can keep track of financial transactions. You should also make sure that your name and address are written clearly in the appropriate fields – this will help expedite the check’s clearance process.

2. Write the name of the payee

It is always important to start your cheque with the recipient’s name and indicate the type of cheque (check, cash, etc.). Next, write down how much money you want to send and where it should be sent. Finally, sign your name at the bottom of the cheque.

3. Write the check amount in numeric form

It is important to include the check amount in a numeric form on the cheque so that the bank can easily match it up with your account.

4. Write the check amount in words

It is important to pay attention to the details when writing a check. By using words rather than numbers, you will avoid any mistakes and ensure that the check is processed in a timely manner. It’s also important to sign your name at the bottom of the check and keep all necessary paperwork in order before writing it – this way, you can be sure that nothing goes wrong during bank authentication or deposit operations.

5. Write a memo

If you are paying someone in person, it’s a good idea to include a memo with the check. This memo can contain any important information related to the payment, such as the date of the transaction or what account was used for this particular payee. It’s also advisable to keep track of all checks written – not only will this make financial processes much simpler in the future, but it will also help prevent fraud and other unlawful activity from happening.

6. Sign the check

After writing the memo and checking the spelling of payee’s name, it is time to sign the check. This should be done in front of a notary or other official witness if necessary. Once all of the details have been verified and signed, you can enclose the check in an envelope and send it off to the bank for processing.

Balancing Your Checkbook

It is important to balance your checkbook every month in order to ensure correct financial management. Here are a few tips that will help you with this:

– Always make sure the total amount of the cheque corresponds to what is on your bank statement. If there are any discrepancies, contact your bank immediately.

– Write your name, account number and routing number at the top of the cheque. This information will be necessary for conducting clearance and settlement processes.

– Make sure that all figures are correct – this includes amounts, cents and decimal points! Incorrect entries can lead to costly mistakes down the line.

Tips for Writing a Check

– Make sure the check is drawn on a bank account that you have checking privileges with and your name is correctly spelled

– Write the memo line at the bottom of the check

– Double-check all of your spelling, numbers and information before writing out your checks

Security Tips

- Develop the following practices to decrease the likelihood of account fraud.

- Make it permanent: Always use a pen when writing checks. If you write your check with a pencil, anyone with an eraser can alter the amount and payee’s name.

- No Blank checks: Do not sign a check until you have filled in the payee’s name and amount. If you are unsure of who to make the check payable to or how much something costs, bring a pen instead of giving someone unlimited access to your bank account.

- Be sure to print the dollar amount in a manner that prevents forgers from adding to it when you fill out the dollar amount on checks. Beginning at the extreme left edge of the space, draw a line after the final digit. For example, place the “8” as far to the left as possible on a check for $8.15. Draw a line from the right side of the “5” to the end of the space, or write the numbers so large that it is difficult to add them. If you leave a space, someone may add digits to your check, resulting in an amount of $48.15 or $8,190.

- If you want a paper record of every check you write, you should purchase checkbooks with carbon copies. These checkbooks include a thin sheet that contains a duplicate of each check written. Thus, you can quickly determine where your money went and what was written on each check.

- Numerous individuals have illegible signatures, and some sign their checks and credit card slips with humorous images. But using the same signature consistently helps you and your bank identify fraud. If a signature does not match, it will be easier for you to prove that you are not responsible for charges.

- Checks payable to cash should not be written. This is as risky as carrying a signed blank check or a large sum of cash.

- Checks are not inherently risky, but there are safer methods of payment. When making electronic payments, there is no paper that can be misplaced or stolen. Electronic payments are typically easier to track because they are already in a format that is searchable and includes a timestamp and the payee’s name.

After You Write the Check

Writing a check can be a daunting task, but with the right steps in mind, the process becomes much simpler. Here are the four basics you need to know before writing a check:

1. Make sure the check is clear and legible

2. Write the date, your name, and the amount of money on the front of the check.

3. Write your name or title below the amount – this will help identify who wrote the check if there is a dispute later on.

4. Sign your name or stamp your seal to certify that you are responsible for this check.

How to deposit a check

The easiest way to direct deposit a check is by using the bank’s online banking system. Once you have written and signed the check, go to your account at the bank and deposit it using the deposit slip that was included in the check package. Keep track of any bank fees that may apply – these can add up if you’re not careful!

Conclusion

Checks are a common form of payment, but there are safer and easier ways to pay your bills. Make sure you understand the basics of writing checks before depositing them, and be prepared for bank fees if you deposit them online.

Frequently Asked Questions

Q.1 How do I know how to write a cheque?

To write a cheque, you need to be aware of the basics of grammar, punctuation and numbering. The most important part is making sure that your cheque looks professional – use correct font size, style and color. Type in all numbers correctly and try not to make mistakes with letters or dashes. Always sign your name at the bottom of the cheque in block letters.

Q.2 What is the difference between a cheque and a bank deposit slip?

A cheque is a formal document that represents money that has been deposited in someone’s account. It’s a written request from the account holder to the bank, and it specifies the account number, the amount of the deposit, the payee name, the payee account number, and the date of the deposit. A bank deposit slip simply records the details of a deposit – it doesn’t necessarily represent a financial transaction. It simply states which account the deposit was made into, the amount of the deposit, the name of the person or institution making the deposit, and the date of the deposit.

Q.3 What are some tips for writing accurate cheques?

When writing cheques, it’s important to verify the information you are writing on the cheque before submitting it to the bank. Make sure all numbers fall within normal ranges, and that typographical errors are corrected. Use standard lettering and numbering for your cheques to ensure accuracy. And lastly, double check that the account holder’s name, address and other contact details match those on the cheque.

Q.4 Can I use my credit card to pay for my groceries with a cheque?

No, cheques cannot be used to pay for groceries with a credit card. Cheques usually take 3-5 working days to clear, which could delay your grocery order by a few days. In addition, cheques are not reversible and cannot be used for cash withdrawals.

Q.5 What is the best way to write a cheque?

When writing a cheque, it is important to make sure the numbers are correct and that the format is correct. There are three main formats for writing cheques: American, British, and Canadian.

American Cheques: These consist of two columns with numbered boxes next to each other. The left-most column contains your account number followed by the amount you are transferring in words or digits. Next comes the payee’s account number, then their name in quotes (if they’re not already contained within parentheses). Finally comes your signature below that information.

British Cheques: Similar to American cheques, but there is one column instead of two and no space between accounts numbers and names. Instead of stating how much money you’re transferring right away, you state at the bottom what type of payment this is – eg “cheque dated”. This allows for quicker processing since banks can determine what type of check it is without needing details such as dates or amounts involved on checks written in British format.

Canadian Cheques: Like British cheques, but typically have spaces after all 123 characters including the decimal point which makes them easier to read when scanning quickly through a line item list printed out from an online bank statement or receipt printer program like Square Cashier .

Q.6 What are the 3 rules for writing a check?

The three rules for writing a check are as follows:

1. Write the name of the person or organization you’re writing the check to at the top of the memo section

2. Doublecheck that all information is correct before signing your name

3. Write the check in full, including the memo and account number

Image Source : Canva