Cryptocurrency isn’t just a new way to invest; it’s also a very different world from traditional stocks and bonds in many ways.

Even for experienced traditional investors, it takes time to learn the basics since there are so many unfamiliar acronyms, new technologies, memes, and tweets.

It can be hard to find your way around the cryptocurrency space when it seems like everyone is speaking a different language.

Find out about some of the most common words and phrases used today in the cryptocurrency and blockchain industries.

Before you buy crypto, you should do a few things, like fill up your emergency fund, pay off high-interest debts, and set up a traditional retirement plan.

As we’ve said before, you should only invest in crypto with money you can afford to lose, and experts say you shouldn’t put more than 5% of your portfolio into these digital assets.

1. Altcoin

Any coin that isn’t Bitcoin is called an “altcoin.” Altcoins can be anything from Ethereum, the second most popular coin, to any of the thousands of coins with very low market value.

Experts say that if you want to invest in cryptocurrencies, you should mostly stick to the bigger, more well-known ones.

2. Bitcoin

Bitcoin is a decentralised form of currency that was first explained in a whitepaper written in 2008 by a person or group using the name Satoshi Nakamoto. Soon after, in January 2009, it launched.

Bitcoin is a peer-to-peer online currency, which means that all transactions happen directly between equal, independent network participants. No middleman is needed to allow or help with these transactions.

Nakamoto said that he made Bitcoin so that “online payments could be sent directly from one party to another without going through a financial institution.”

3. Blockchain

A blockchain is a type of data structure that lets a network of independent parties create and share a digital ledger of data.

The records and histories of transactions that blockchains make are permanent, but nothing is really permanent.

A blockchain is a peer-to-peer system in which no one person or group controls the flow of information. One of the best ways to get rid of central control and keep data integrity is to have a large network of independent users who are spread out.

4. Bullish

Expecting the Price will increase.

A bull market, also called a “bull run,” is a time when most investors are buying, demand is higher than supply, confidence in the market is high, and prices are going up.

If you look at a market and notice that prices are going up quickly, this could mean that most investors are becoming optimistic, or “bullish,” about the price going up even more. This could be the start of a bullish market.

5. Fiat

Fiat money is money made by the government that is not backed by something like gold.

Central banks have more power over the economy with fiat money because they can decide how much money to print. Most paper money in use today, like the U.S. dollar, Indian Rupees, and Euro are Examples of a fiat currency.

6. Bearish

Expecting the Price will Decrease

Bear markets are times when there is more supply than demand, people don’t trust the market, and prices are going down.

“Bears” are investors who are pessimistic and think prices will continue to go down. Bear markets can be hard to trade in, especially for people who haven’t done it before.

It is notoriously hard to tell when the bear market will end and when the bottom price has been reached.

Most of the time, rebounding is a slow, unpredictable process that can be affected by many outside factors, such as economic growth, investor psychology, and news or events from around the world.

7. Going Long

Long positions are where an investor gains exposure to cryptocurrency with the expectation that prices will rise at a later date, meaning that the asset can be sold for a profit. It is the opposite of a short position.

8. FOMO

FOMO is more about the person. It’s the worry that they won’t be able to enjoy something that other people are (for example the fear of missing out on Bitcoin gains while others are picking out their Lambos).

FOMO could make you buy a coin, not take profits on a coin, or not set stops on a coin that has already gone up a lot.

It’s the idea that if you take a reasonable profit now or wait for a reentry point, you’ll miss out on the market.

People buy at the top or hold on during a drop after making money because they don’t want to miss out (only to lose some or all of their profits again). People are said to have FOMO when they act on the spot because they don’t want to miss out.

9. HODL

HODL is the misspelt word of HOLD which means “Hold for a Dear Life”

This is used in the crypto world whenever the trader holds their coins for higher profit.

Due to the fact that cryptocurrencies are very volatile, traders have a lot of chances to build up long and short positions.

But “hodling” can give investors more security because they won’t be affected by short-term volatility and won’t run the risk of buying high and selling low.

10. ATH

ATH means “highest point ever reached.” In cryptocurrency and online trading, the all-time high (ATH) is the highest price or market capitalization that an asset has ever had since it was listed.

Since ATH is the peak price, it can be used to talk about how much an asset might be worth.

People who invest in capital markets have been talking about “all-time highs” for a long time.

When the economy is doing well, stock prices that reach new highs are seen as a sign that companies are doing well.

11. Going Short

To get into a short position, you’ll need to borrow cryptocurrencies and sell them on an exchange at the current price.

Then, at a later date, you will have to buy the cryptocurrency and pay back the money you borrowed.

If the price goes down when it’s time to pay back your loan, you make money from the difference between what you bought and what you sold it for.

12. FUD

FUD is another piece of technical language that is often used in the crypto world. It stands for “fear, uncertainty, and doubt,” which are all feelings that people often have.

The term itself refers to a certain way of thinking that is pessimistic about an asset or market.

It’s a way to spread a lot of fake bad news about a crypto coin and its future in order to make people nervous or afraid of it.

13. ROI

ROI is a metric that cryptocurrency traders use to measure how well an investment is doing or to compare how well different investments in a portfolio are doing.

Cryptocurrency traders should keep an eye on the ROI number and make changes to their portfolios as needed.

A positive ROI means that the crypto investment is making money, while a negative ROI means that the investment is losing money.

Investors who want to put money into a crypto project through a token sale may ask to see the return on investment (ROI) or the ROI that is expected.

ROI is found by taking the initial value of the investment and subtracting it from its current value. The result is then divided by the initial value of the investment.

14. Wallet

A cryptocurrency wallet is where you keep your coins. For your wallet to work, it needs to have seeds, keys, and addresses.

There are different kinds of wallets, like hardware wallets and software wallets. A software wallet is something like a phone app that you use to store your crypto. I use a hardware wallet to keep my cryptocurrency safe.

Hardware wallets are harder to use, but they offer more security than software wallets.

Why? Well, since Exchange Wallets have security holes, I could lose all of my crypto if someone broke into one. Unless strangers find a way to get into the recovery seed I keep in my house, it is almost impossible for someone to hack into my hardware wallet.

15. Fudster

A FUDster is an individual or a Group of people who is intentionally spreading FUD.

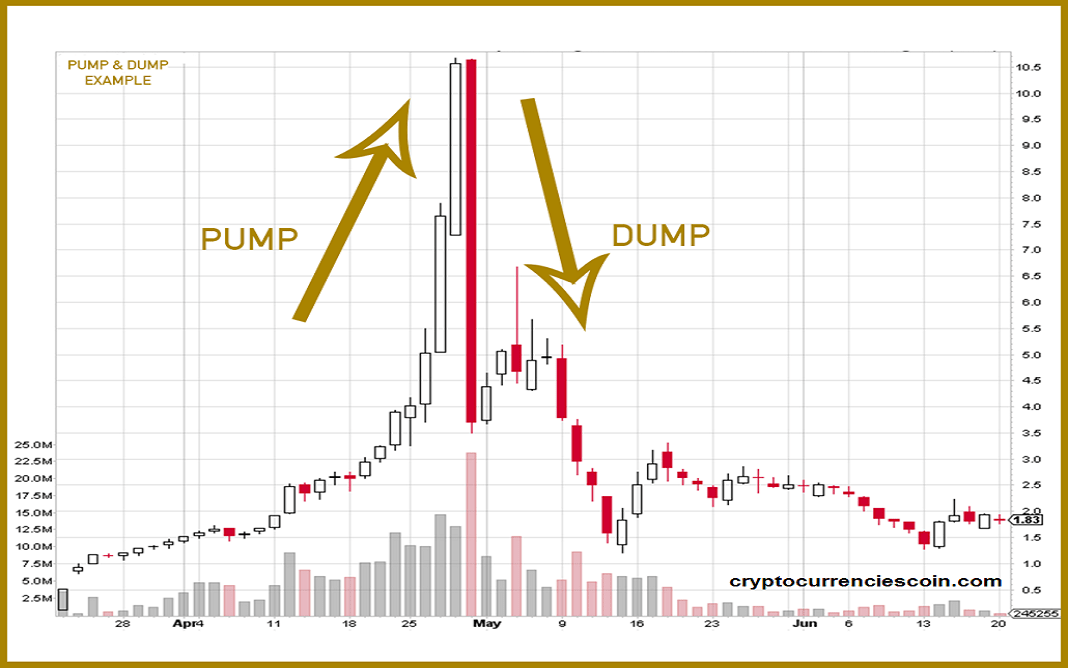

16. Pump & Dump

Crypto pump-and-dumps are when people work together to raise the price of a currency by spreading false information. They then sell the currency for a profit.

17. Exchange

On a crypto exchange, you can buy and sell digital currencies.

You can trade one cryptocurrency for another on an exchange, like Bitcoin for Litecoin, or you can use regular money, like the U.S. Dollar, to buy cryptocurrency.

The prices of the cryptocurrencies they offer are based on the current market prices.

On an exchange, you can also turn cryptocurrencies back into the U.S. Dollar or another currency, which you can leave in your account as cash (in case you want to trade back into cryptocurrencies later) or withdraw to your regular bank account.

18. Defi

Decentralized finance (DeFi) is a new financial technology that uses secure distributed ledgers like those used by cryptocurrencies.

Banks and other institutions no longer have control over money, financial products, and financial services.

Some of the things that many people like best about DeFi are:

- It gets rid of the fees that banks and other financial companies charge for using their services.

2.Instead of putting your money in a bank, you keep it in a safe digital wallet. - Anyone with an internet connection can use it without getting permission.

- You can send money in a matter of seconds or minutes.

19. Decentralized

In the blockchain, “decentralisation” means that control and decision-making are moved from a central organisation (a person, a company, or a group of people) to a network of people all over the world.

Decentralized networks try to make it so that members don’t have to trust each other as much and can’t use their power or authority over each other in ways that would hurt the network’s effectiveness.

20. Gas Fees

Gas fees are what users pay to cover the energy used by computers to process and verify transactions on the Ethereum blockchain.

“Gas limit” means the most gas (or energy) you are willing to spend on a specific transaction.

21. Market Cap

The total value of all of a cryptocurrency is its market capitalization. Where the stock market capitalization is found by multiplying the price of a share by the number of shares that are in circulation.

The market capitalization of a cryptocurrency is found by multiplying its price by the number of coins in circulation.

22. Smart Contract

Smart contracts are just pieces of code that are stored on a blockchain and run when certain conditions are met.

Most of the time, they are used to automate the execution of an agreement so that all parties can know right away what will happen, without having to wait for an intermediary or lose time.

23. Token

Usually, any cryptocurrency besides Bitcoin and Ethereum is called a “token” (even though they are also technically tokens).

Since Bitcoin and Ethereum are by far the two biggest cryptocurrencies, it’s helpful to have a word for all the others. (You might also hear the word “altcoin,” which means almost the same thing.)

The other meaning of “token” that is becoming more common is even more specific. It refers to crypto assets that run on top of the blockchain of another cryptocurrency.

24. Coin

Coins are any digital currency that has its own blockchain and can be used by itself, like Bitcoin.

These cryptocurrencies are built from scratch, and the network as a whole is made with a specific goal in mind.

For example, Bitcoin is a safe way to store and exchange value that can’t be censored and has a fixed monetary policy.

Bitcoin’s native token, BTC, or bitcoins, is the most liquid cryptocurrency on the market and has the highest market cap and realised market cap in the cryptocurrency sector.

25. Mooning

A term that is often used as a verb (mooning) to describe a cryptocurrency that is on a strong upward market trend.

This phrase is also often used in the phrase “to the moon,” which means that a person is sure that the price of a certain cryptocurrency is about to go up a lot.

26. Nft

NFT stands for “non-fungible token.” A non-fungible token is one that can’t be swapped or replaced because it has its own unique properties.

What It Has:

- Digital Asset: NFT is a digital asset that represents collectables on the Internet, such as art, music, and games, and comes with a certificate that proves it is real. This certificate is made by the blockchain technology that makes Cryptocurrency possible.

- It can’t be copied or changed in any other way.

- Exchange: Non-fiat currencies are traded on specialised sites using digital currencies like Bitcoin.

Disclaimer –

Investing in cryptocurrencies and other initial coin offerings (ICOs) is very risky and speculative, and neither Financetoall nor the writer of this article is recommending that you do so , Because everyone’s financial situation is different, you should always talk to a professional before making any financial decisions.

Financetoall doesn’t promise or guarantee that the information on this website is correct or up-to-date, because things like market cap vary each day. The information on this website is not meant to be taken as investment advice, financial advice, trading advice, or any other kind of advice, and you shouldn’t take any of it that way.

Financetoall does not recommend that you buy, sell, or hold any cryptocurrency. Before making any investment decisions, you should do your own research and talk to a financial advisor.

Please Share , comment for Suggestions !